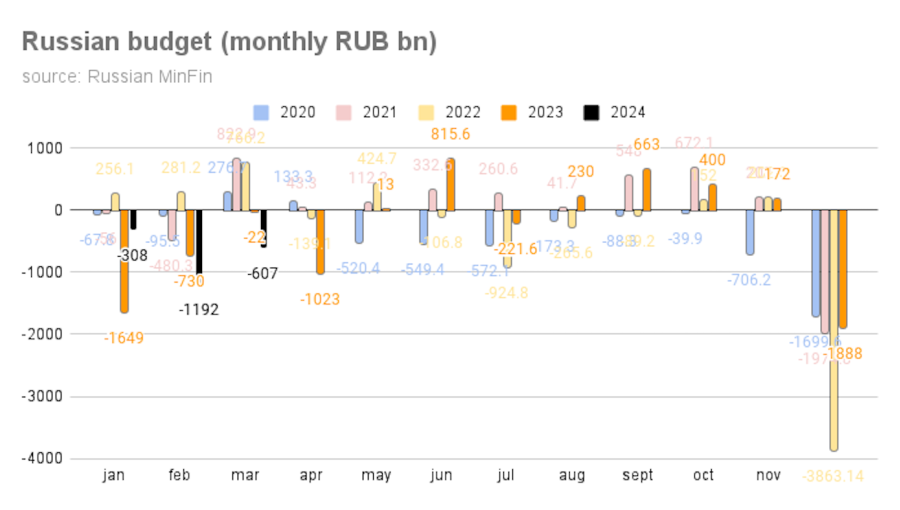

Russia’s federal budget deficit shrank to RUB607bn ($6.7bn) in the first quarter thanks to high oil prices that pushed up oil and gas revenues by 80%, according to a preliminary estimate of the Ministry of Finance (MinFin).The first quarter budget results have been keenly anticipated by analysts to see what effect the new US smart sanctions would have on oil and gas revenues.As bne IntelliNews reported, one year on after the disastrous budget results at the start of 2023 when the deficit hit RUB1.7 trillion, the deficit blew out again in the first two months of this year to hit RUB1.5 trillion, or 96% of the full year deficit level planned for this year, or RUB1.6 trillion.

However, last year the target deficit for the full year was 2% of GDP, whereas the full year target for this year is a more modest 0.8%.MinFin will be pleased by the current results which has seen the deficit recede significantly, largely thanks to high prices for oil which topped $90 a barrel this week that is largely offsetting the improved oil price cap sanctions regime that is increasingly targeting individual ships and shipping companies delivering Russian oil to its friendly countries.

Revenues stood at RUB8.7 trillion, which is 53.5% higher year on year, while spending increased by 20% y/y to RUB9.3 trillion. (chart)In particular, oil and gas budget revenues soared by 79% y/y to RUB2.9 trillion, albeit from a low base, while non-oil and gas revenues increased by 43% y/y, to RUB5.8 trillion of which more than half was made up from VAT collections.

The non-oil collections are also helping reduce the budget as consumption and industrial production boom on the back of the military Keynesianism stimulus. The labour market is drum tight and unemployment has fall to record lows of 2.8% of the population in February that has pushed up both nominal and real incomes and is fuelling domestic consumption that translates into better VAT collections.

Oil and gas revenue growth was attributed to the growth of prices for Russian oil, as well as a one-time receipt in February of additional payment on mineral extraction tax on oil for the fourth quarter of 2023.According to the latest forecast of the Ministry of Economy, the average export price of Russian oil in 2024 is expected at $71.3 per barrel. Budget expenditures are forecasted at RUB36.6 trillion, revenues at RUB35 trillion, and the deficit at RUB1.6 trillion, or 0.9% of GDP.

S&P Global issued a note the same week saying the global oil market is already tight as OPEC’s voluntary cuts have reduced supply and expect the market to become tighter in the second half of this year that will keep oil prices elevated.In March alone, oil and gas revenues surpassed February revenues by almost 40% and totalled RUB1.31 trillion.

“In general, the volume and trajectory of receipt of the largest non-oil and gas taxes at the end of the first quarter of 2024 indicate a significant excess of the dynamics laid down in the formation of the budget law,” the MinFin commented, as cited by RUBC business portal.To remind, the MinFin is under pressure to maintain the fiscal performance guidance for 2024 after in the first two months of the year the federal budget deficit blew out to unprecedented proportions.

The Russian budget had been reporting surpluses for eleven months in a row in 2022, but collapsed completely that December, ending the year RUB3.3 trillion in deficit, or 2.3% of GDP after the state was hit with a massive RUB3.9 trillion of spending obligations. The Russian budget always does about a fifth of the whole year’s spending in December, but in 2022 the spending was off the scale and ate up all the surpluses accumulated during the year and then a few trillion more.

Things in January 2023 got even worse. The second of the oil sanctions on oil products wasn’t due to go into effect until February 5 but the threat of its effects had already made themselves felt and Ministry of Finance (MinFin) started the year with a whopping RUB1.7 trillion deficit – the largest January deficit on record and already equivalent to half of the full year’s expected deficit.

The government used up half of its rainy day National Welfare Fund (NWF) last year to support the budget the liquid part of which fell from RUB6.8 trillion at the start of 2023 to RUB4.8 trillion by the end of the year. However, with the projected deficit for 2024 at RUB1.6 trillion, there is still enough in just the NWF to cover this year’s deficit completely three-times over. And MinFin has been increasingly tapping the Russian Finance Ministry’s OFZ treasury bills market to spread the load and preserve cash in the NWF in case of unforeseen circumstances.

MinFin’s hand is further improved by the continuously falling external debt. Russia external debt has been falling steadily and reached $326.6bn in December 2023, compared with $322.3bn in the previous quarter and $383.6bn at the end of 2022. It could pay the entire amount off tomorrow – in cash.

Source:https://www.intellinews.com