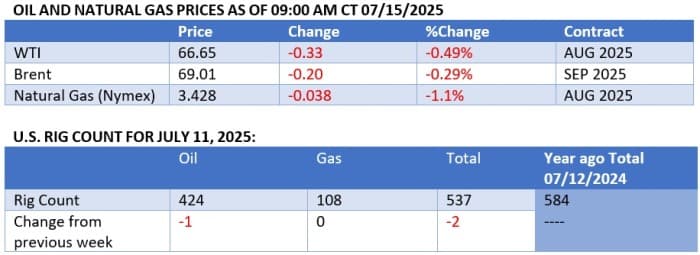

Oil markets have largely ignored Trump’s threats to impose 100% secondary tariffs on any country that buys Russian exports, with prices dropping significantly on Tuesday morning.

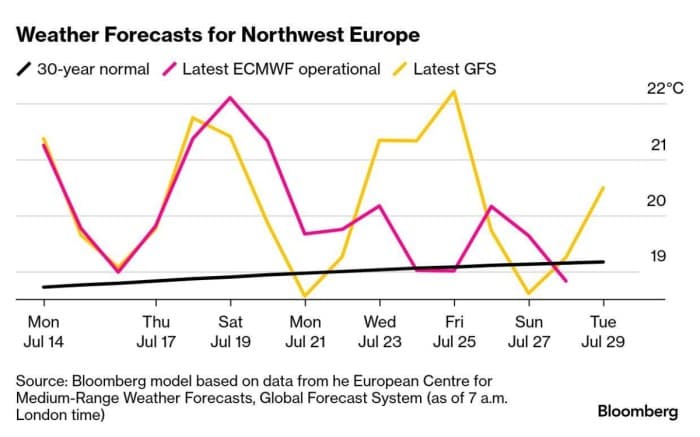

– European natural gas prices have posted a five-day hot streak as Northeast Asian heatwaves drained South Korean and Japanese inventories, prompting buyers to divert cargoes there, only for Europe to confront its own sultry weather.

– Front-month TTF gas futures, the benchmark for the European market, moved up to €35 per MWh ($13/mmBtu) as US President Trump’s threats to slap a 100% tariff on any buyers of Russian energy (including Central European countries such as Hungary, Slovakia or Serbia) added a layer of bullishness.

– European temperatures have been above seasonal average by 2-3° C throughout July, and it is only by the end of this month that they will converge with historic norms, limiting gas inventory builds.

– EU natural gas inventories stood at 63% full as of July 15, a whopping 17 percentage points below last year’s levels, suggesting that European LNG buying would speed up into August-September after June imports were 9.1 million tonnes, a 2% drop compared to May.

Market Movers

– US oil major Chevron (NYSE:CVX) indicated that the Mars crude stream zinc contamination was caused by the start-up of an offshore well, prompting the US Department of Energy to release 1 million barrels of SPRs to Louisiana refiners.

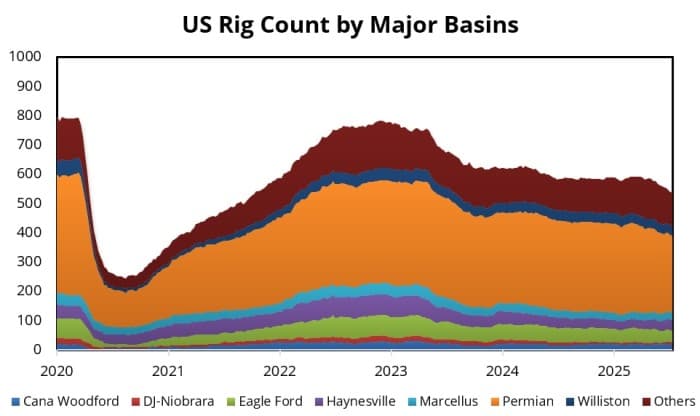

– Taiwan’s state-controlled energy company CPC is reportedly seeking to purchase shale gas producing assets in the US, potentially even buying parts of Aethon Energy Management’s $8 billion Haynesville portfolio in case Mitsubishi’s bid falls through.

– US upstream firm Hess Energy (NYSE:HES) has relinquished its 100% held offshore Block 59 in Suriname as it failed to find new partners following the 2024 exit of ExxonMobil and Equinor.

– Abu Dhabi’s gas company ADNOC Gas (ADX:ADNOCGAS) signed a three-year $400 million LNG term deal with Germany’s SEFE for the delivery of 0.7 million tonnes of LNG over the next three years.

Tuesday, July 15, 2025

Donald Trump’s 50-day deadline for Russia has failed to wake prices from their slumber, even as OPEC doubled down on its forecast of an exceptionally tight summer, with ICE Brent staying put slightly below the $70 per barrel mark. China’s much-sought return to relatively normal levels of refining didn’t provide any tangible boost either, most probably suggesting that the summer holiday season is taking its toll on commodity trading.

Trump Threatens Russia with 100% Tariffs. US President Donald Trump said he would impose 100% secondary tariffs on any country that buys Russian exports if Moscow does not reach a peace deal with Ukraine in the next 50 days, targeting India, China and Turkey, the three largest buyers of Russian oil.

Saudi Arabia Fires on All Cylinders. The IEA reported that Saudi Arabia’s June production soared to 9.8 million b/d, almost 0.5 million b/d higher than the Middle Eastern kingdom’s 9.367 million b/d quota for the month, indicating that Aramco has joined the ranks of OPEC+ overproducers.

China’s Refineries Finally Step Up Their Game. China’s crude oil throughput rose to 15.15 million b/d in June, an 8.5% year-over-year increase and the highest monthly reading since September 2023, as state-owned refiners maximized runs to a nationwide 80% amidst improved margins.

White House Stands with Oil, Not Whales. The Trump administration will delay by two years a final rule designating protection areas for the endangered Rice’s whale, of which only 100 specimens remain in the oil-rich waters of the Gulf of Mexico, de-risking offshore drilling until at least 2027.

Plaquemines Readies for Start of Phase 2. US LNG developer Venture Global (NYSE:VG) has started producing liquefied natural gas from Plaquemines Phase 2, pulling a record 2.9 BCf per day of feedgas, with an aim to reach full commissioning of six new liquefaction blocks by mid-2027.

Weak Home Sales Depress Iron Ore Prices. China’s new home prices posted the steepest decline in eight months last month, falling 3.2% year-over-year, dragging the iron ore futures benchmark in Dalian lower to ¥765 per metric tonne ($106/mt), with steel demand further weakened by heavy rainfall.

Drone Attacks Hamper Kurdish Oil Production. Following drone attacks that are believed to have come from areas under the control of Iran-backed militias, the Sarsang oil field in Iraqi Kurdistan was forced to halt production, only two days after the region’s largest asset in Khurmala was attacked.

Rio Tinto Sticks To Iron Guns. Mining giant Rio Tinto (NYSE:RIO) named the head of its iron ore segment, Simon Trott, as the company’s new chief executive, taking over from Jakob Stausholm, who was reportedly reluctant to commit to transformative mergers, including the one with Glencore

India Eases Coal Power Emission Rules. India reversed a 2015 mandate to install $30 billion worth of flue-gas desulphurization (FGD) systems on coal power plants to reduce exhaust gases, exempting roughly 80% of nationwide coal capacity on the grounds that they’re outside a 6-mile radius of city limits.

Google Locks In Hydro Megadeal. US tech giant Google (NASDAQ:GOOG) signed the world’s largest corporate renewable energy deal for hydroelectricity, inking a 20-year power purchase agreement with Brookfield Asset Management for power from the latter’s two hydro plants in Pennsylvania.

India Talks to Chile to Secure Critical Minerals. The government of India is negotiating with Chile and Peru to source critical minerals under ongoing free trade deal talks, seeking to fix annual volumes of copper concentrate to be delivered as its copper dependency stands at a whopping 90%.

South Africa Softens Drilling Stance. South African authorities allowed UK-based energy major Shell (LON:SHEL) to drill up to 5 deepwater wells in the Orange Basin off the country’s west coast, marking a notable change after Pretoria’s intransigence prompted TotalEnergies to relinquish its assets.

Nigeria Keeps on Dreaming Big. Africa’s leading oil producer, Nigeria, is seeking to increase its OPEC+ production quota from the current 1.5 million b/d to 2 million b/d, even though oil theft and sabotage attacks have kept its crude production below its target since February 2025.

By Michael Kern for Oilprice.com