EIG Global Energy Partners’ MidOcean Energy said it has entered into definitive agreements to invest in Petroliam Nasional Bhd’s (Petronas) Canadian businesses, including by acquiring a stake in the recently fired up LNG Canada.

“The transaction includes a 20 percent interest in the North Montney Upstream Joint Venture (NMJV), which holds Petronas’ upstream investment in Canada, and a 20 percent interest in the North Montney LNG Limited Partnership (NMLLP), which holds Petronas’ 25 percent participating interest in the LNG Canada project”, MidOcean said in a statement on its website.

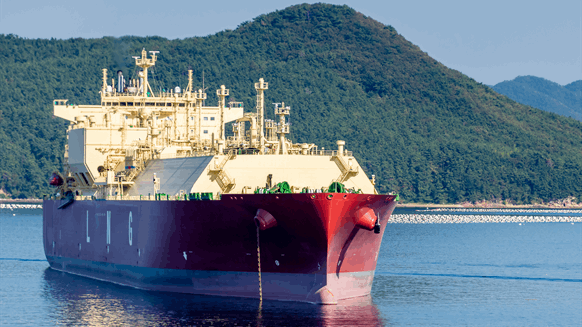

With a capacity of 14 million metric tons per annum (MMtpa) from two trains, LNG Canada targets the Asian market. The LNG Canada joint venture announced June 30 the Kitimat, British Columbia facility had dispatched its first cargo, introducing Canada as an LNG-exporting country.

The LNG Canada joint venture said at the time it was studying the potential to expand with two more trains, which would double the capacity.

Shell PLC is the biggest owner in LNG Canada with 40 percent through Shell Canada Energy. Malaysia’s state-owned Petronas holds 25 percent through NMLLP. Japan’s Mitsubishi Corp and China’s state-backed PetroChina Co Ltd each have 15 percent through Diamond LNG Canada Partnership and PetroChina Kitimat LNG Partnership respectively. Korea Gas Corp owns five percent through Kogas Canada LNG Partnership.

Meanwhile the NMJV holds over 800,000 gross acres of mineral rights with 53 trillion cubic feet of reserves and contingent resources, MidOcean noted.

“Following completion of the transaction, MidOcean will hold a position across the integrated value chain, spanning upstream resource development in the North Montney and downstream liquefaction and export through LNG Canada via its participation in NMLLP”, MidOcean said. “Through this partnership with Petronas, MidOcean will have the ability to secure an associated LNG Volume of 0.7 MTPA with potential to grow through LNG Canada Phase II”.

MidOcean chair and EIG chief executive R. Blair Thomas said, “Our participation further strengthens MidOcean’s portfolio, secures meaningful LNG offtake and reinforces our commitment to building a diversified and resilient LNG business for the decades ahead”.

MidOcean expects the transactions with Petronas to be completed in the fourth quarter.

Petronas said separately it “remains committed to its investments in Canada and this equity participation will not affect Petronas’ existing control over NMJV and NMLLP”.

The partnership with Petronas represents the second LNG investment announced by MidOcean this year. Earlier it signed a preliminary deal to shoulder 30 percent of construction costs and be entitled to 30 percent of production at Energy Transfer LP’s planned Lake Charles LNG in Louisiana.

“This agreement has the potential to transform MidOcean’s portfolio, providing a material volume of advantaged Atlantic Basin supply”, MidOcean chief executive De la Rey Venter said in a statement August 9. “This complements our current assets, which are allocated in the Asia-Pacific Basin.

“Geographical diversity is a key enabler for value delivery from an LNG portfolio. MidOcean considers Lake Charles LNG to be one of the most advantaged US LNG projects under development”.

MidOcean said its share of Lake Charles LNG production would be around five MMtpa.

“The HOA [heads of agreement] also provides that MidOcean Energy will have the option to arrange for gas supply for its share of LNG production and that MidOcean will commit to long-term gas transportation on Energy Transfer pipelines”, MidOcean said.

Source: by Jov Onsat, Rigzone Staff