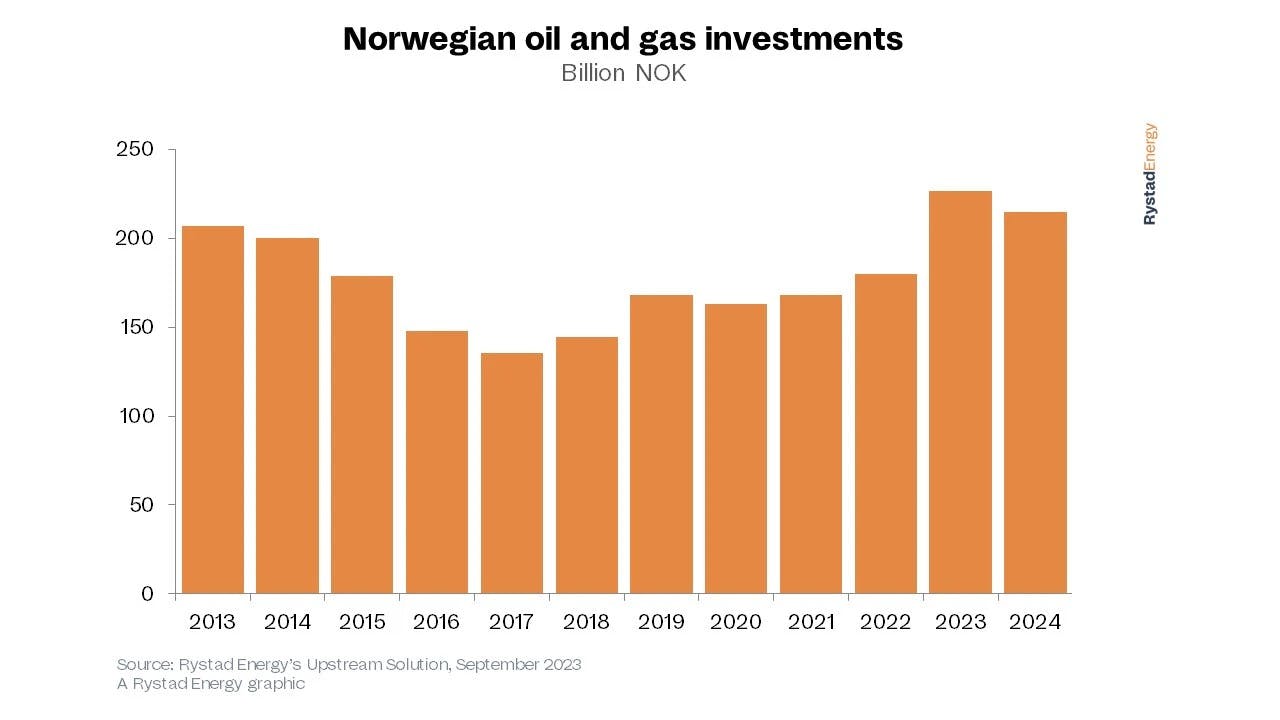

OSLO, Norway — Investments in Norway’s oil and gas industry could surge to a record NOK225 billion ($21 billion) this year, according to Rystad Energy.

Various major offshore projects have secured approval in recent years, in part incentivized by the country’s temporary tax regime, introduced in 2020.

Following a decline of almost 15% in production across the Norwegian Continental Shelf, from a peak of nearly 4.6 MMboe/d in 2004, oil and gas output is on the rise, potentially heading back toward peak levels by 2025 as new volumes come onstream.

In the UK, however, Rystad expects 2023 investments to be about 75% lower than the peak of 2013, when spending approached £18 billion ($22.7 billion). But next year the UK government could potentially sanction the highest number of new projects in a decade covering up to 14 new oil and gas fields.

The three largest projects are Rosebank, Cambo and Clair Phase 3, all west of Shetland. If all get the green light, 2024 sanctioning activity could amount to about £9.5 billion ($12 billion).

In terms of exploration, Rystad forecasts 35 wells offshore Norway this year and 36 in 2024. And the year to date has been a good one for new finds, unlocking similar volumes to last year’s total with only about half of the planned wells for 2023 completed to date.

Source:https://www.offshore-mag.com/