Crude prices fell on Tuesday ahead of official inventory data as traders continue to focus on demand risks in China.

Editor’s Note: With the EU ban on Russian crude just weeks away, analysts are hiking price targets for early 2023. Our Global Energy Alert analysts have identified a number of opportunities to play tight oil markets at the end of this year and in 2023. Subscribe to Oilprice.com’s premium service today and receive fundamental and technical analysis along with carefully selected energy stock picks from our house-trader David Messler.

Chart of the Week

China’s Recovery Will Take Months If Not Years

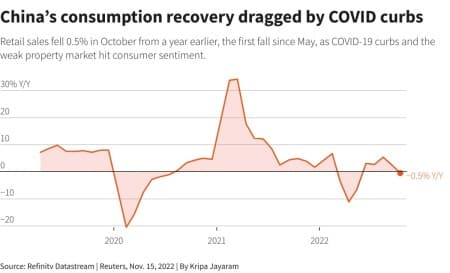

– Despite a weeklong holiday that usually supports domestic consumption in October, last month’s China data have provided a grim outlook for Q4 demand amidst surging Covid cases in the country.

– Positive cases (some 16,000 per day already) are on par with levels seen in late April when Shanghai went into full lockdown, prompting market watchers to cut China’s GDP growth even further to 3.0-3.5%.

– Chinese oil buying is still yet to increase above levels seen in the spring months of 2022 – even in October exports to China were still only 9.4 million b/d according to Kpler data, 6% lower year-on-year.

– China’s economy is still rattling from the impacts of the lockdown, with October factory output growing slower than expected (up 5% year-on-year) and retail sales dropping for the first time since May 2022.

Market Movers

– Breathing new life into the chipmaking market, Berkshire Hathaway (NYSE:BRK) disclosed a $4.1 billion stake in Taiwan’s TSMC (TPE:2330), sending the company’s shares soaring by 20% in the last two days.

– Having already committed $6 billion to an EV battery plant in Indonesia, China’s battery maker CATL (SHE:300750) is to set up a $2 billion electric vehicle fund in the Asian country along with its sovereign wealth fund.

– Australia’s frontier oil company Invictus Energy (ASX:IVZ) more than tripled after the company announced it struck gas with its Mukuyu-1 wildcat well in Zimbabwe, a frontier-opening find.

Tuesday, November 15, 2022

The upbeat sentiment that swept across global markets last week following news of China opening up and relaxing some of the punitive coronavirus measures that were in place previously has given way to pessimism again. It’s the same Beijing syndrome that the oil markets have developed over the past two years – picking up good news before they are smashed by another wave of COVID cases, this time around Beijing being the epicenter of new cases. In addition to lower demand forecasts by the IEA and OPEC, demand concerns are making headlines again, pushing ICE Brent to $92 per barrel.

OPEC Production Cuts Augured Demand Revisions. In its latest monthly report, OPEC cut its forecast for oil demand growth in both 2022 and 2023 by 100,000 b/d, anticipating 2023 to see crude demand going up by 2.24 million b/d with risks skewed to the downside amidst recession fears.

Biden-Xi Meeting Fosters Hope of Climate Deal. In the first face-to-face encounter between U.S. President Joe Biden and China President Xi Jinping since the former took office, the two agreed to work together on climate goals even though the issue was given a lower priority in the Chinese communique. Related: Russia’s Oil Production Could Drop By 1.4 Million Bpd In 2023

U.S. Greenlights India’s Buying of Russian Crude. The U.S. is happy for India to buy as much Russian oil as it wants, provided it steers clear of Western insurance, finance and maritime services bound by the G7-imposed oil price cap, said U.S. Treasury Secretary Janet Yellen when visiting India.

IEA Flags Lower Diesel Demand in 2023. With both sides of the Atlantic Basin experiencing an unprecedented diesel squeeze, the International Energy Agency forecasts diesel demand will decline slightly next year, following two consecutive years of growth totaling some 2 million b/d.

Freeport LNG Restart Delayed. The U.S.’ second-largest LNG plant Freeport LNG has not yet provided Texas regulators with a final repair plan after it sought to bring the liquefaction facilities back by mid-November after a June 2022 blaze, and will see its restart being pushed into Q1 2023.

Five Iranian Tankers Lose Their Flags. The latest round of U.S Treasury sanctions on companies involved in Iranian crude shipments has resulted in five tankers registered in Djibouti and the Cook Islands losing their flags, all are currently active in Venezuelan waters.

CPC Terminal Restarts as Kazakhstan Sighs in Relief. The Caspian Pipeline Consortium in southern Russia restarted operations at the single mooring point-1 after prolonged repair works, finally allowing Kazakhstan to maximize its crude exports via the 1.3 million b/d pipeline.

Europe Can’t Let the French Strike Alone. Only several days after the last French refinery halted its strike, workers at the BP-operated (NYSE:BP) 400,000 b/d Rotterdam refinery started a work-to-rule industrial action after unions failed to reach a new pay agreement, making Europe’s diesel woes even riskier.

U.S. Drillers See Fracklog Rise Again. As reported by Bloomberg, U.S. oil and gas companies fracked fewer wells than they drilled for the first time since June 2020, ending a 27-month streak of declines in the DUC count and indicating a slowdown in production amidst declining well productivity.

Fully Stocked Terminals Bearish for Asian LNG. Just as European gas prices started increasing on the back of this winter’s first cold streak, Asia has turned decidedly bearish as LNG importers are experiencing high stock levels and tank-tops (especially in South Korea), pushing JKM prices down to $25/mmBtu.

LME Refuses to Ban Russian Metal into 2023. The London Metal Exchange announced its decision not to ban Russian metal in its warehouses looking forward, arguing that a “material portion of the market is still relying on it” and that there has been no indication of a surge in shunned inventories.

Improving China Real Estate Lifts Iron Ore. Amidst improving market sentiment over China’s residential property sector, prices of spot iron ore delivered into north China bounced back from a three-year low of $79/mt seen in late October to some $92/mt recently.

South Africa’s Power Crisis Will Be Prolonged. With South Africa’s power generation still 80% reliant on coal, the ongoing unprecedented streak of power cuts and rolling blackouts is expected to continue as the country lacks adequate renewable energy alternatives.

SOURCE:Chinese Demand Concerns Continue To Spook Oil Markets | OilPrice.com