After climbing by 13% in July, oil prices were dragged lower on the first day of August by further disappointing economic data out of China.

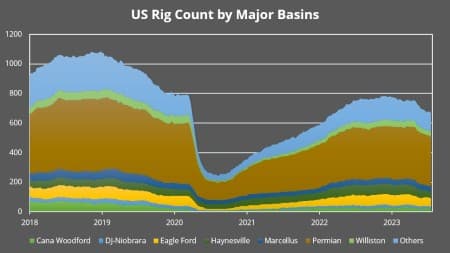

Chart of the Week

– Boosting the effect of Saudi Arabia’s production cuts, oil production in Canada’s crude heartland Alberta fell to the lowest since June 2016 as producers doubled down on field maintenance.

– According to AER data, Alberta’s oil output dropped 21% year-on-year to 2.71 million b/d as oil sands mines, usually undergoing field maintenance in the summer, posted the highest decrease rates.

– In a surprise move, production figures from Suncor (NYSE:SU) were not included in AER data, with Canadian authorities claiming the oil firm didn’t file its production results, potentially a consequence of a late June cyber hack that debilitated the company’s operations.

– Consequently, Canada’s leading midstream operator Enbridge accepted all crude nominations for its 3 million b/d Mainline pipeline system in August, the second consecutive without apportionment as supply remains low.

Market Movers

– UK energy giant Shell (LON:SHEL) has resumed negotiations with relatively unknown Nigerian firm ND Western to sell its onshore and shallow-water fields in Nigeria, seeking to exit the country as soon as possible.

– Mining giant Glencore (LON:GLEN) agreed to buy a 56% stake in Argentina’s Minera Agua Rica Alumbrera project from Pan American Silver for $475 million, boosting its global copper portfolio.

– US oil major ExxonMobil (NYSE:XOM) is reportedly in talks with carmakers Tesla (NASDAQ:TSLA) and Ford (NYSE:F) to supply lithium from its Arkansas plant jointly developed with Tetra Technologies.

Tuesday, August 01, 2023

Oil bulls thoroughly enjoyed the 13% month-on-month increase in oil prices in July, but the first day of August provided another head-scratcher as Chinese manufacturing contracted in July with the PMI index dropping to 49.2. Perceived as a positive sign for metals markets that expect Beijing to splash the cash on stimulus, Chinese woes have nevertheless halted the rise in oil prices, sending ICE Brent below $85 per barrel. However, should Saudi Arabia extend its 1 million b/d production cut, there might be a new bullish narrative to counter the year-long Chinese blues.

Goldman Upgrades Oil Price Outlook. US investment bank Goldman Sachs (NYSE:GS) revised its global oil demand outlook, seeing an all-time high of 102.8 million b/d demand this July and sticking to a $93 per barrel 12-month price projection on a healthier outlook for global economic growth.

Canada Rekindles Interest in Nuclear. As Canada races to meet future power demand, the government of Ontario announced the expansion of the Bruce Power facility, to hit 11 GW capacity and become the world’s largest nuclear plant, as well as three smaller modular reactors.

UK Promises Licensing Bonanza in Policy U-Turn. The UK government pledged to grant hundreds of licenses for North Sea oil and gas exploration over the upcoming years as part of a wider drive to become energy self-sufficient, building on this year’s licensing round that saw 115 bids for offshore projects.

Trinidad Gas Field Incident Halts Petchem Industry. After Australia’s Woodside Energy (ASX:WDS) shut its production platform offshore Trinidad and Tobago, citing an unspecified process safety incident, the island country’s methanol and ammonia plants in Point Lisas were forced to halt operations, too.

Heatwave Sends US Gasoline Prices Soaring. US national gasoline prices gained 16 cents per US gallon last week, hitting $3.75/USG on Monday, as heat-related refinery outages curbed product supply and robust countrywide demand lowered gasoline stocks to their lowest July level since 2015.

Nigeria Hails the Scrapping of Gasoline Subsidy. Recently inaugurated Nigerian President Bola Tinubu said the scrapping of gasoline subsidies previously provided by the government has saved the government some $1.3 billion in just two months, whilst retail prices have tripled in the same period.

Calcasieu Pass 2 Finally Gets Govt Approval. Venture Global LNG’s proposed Calcasieu Pass 2 project received the US Federal Energy Regulatory Commission’s environmental approval, clearing the way for the LNG developer to take an FID later this year on the 20 mtpa capacity liquefaction plant.

Niger Coups Jeopardizes Regional Oil Supply. The military coup in Niger might put a halt to the country’s oil growth plans as the 110,000 b/d Niger-Benin export pipeline is 75% ready and should be followed by a ramp-up in production from Chinese-operated fields in the Agadem Rift basin.

Petrobras Dividend Policy Set Lower. A long-time favorite of dividend investors, Brazil’s national oil company Petrobras (NYSE:PBR) revised its dividend policy downwards by pledging to allocate 45% of its free cash flow to payouts, down from the current rate of 60%.

South Korea, the New Favourite of Chinese Firms. Chinese EV battery firms are rapidly increasing their investments in South Korea, with recently announced projects adding up to at least $4.4 billion, qualifying for IRA tax credits that require batteries to be sourced from the US or a free trade partner.

US Crude Demand Hits Post-Pandemic Highs. According to EIA data, the volumes of US crude and oil products supplied, a proxy for demand, rose to 20.78 million b/d in May, the highest since August 2019, and will most probably rise even further as official data for June and July trickle in.

Chinese Starts Exports Controls on Gallium/Germanium. International metal traders are bracing for a sizable decline in supply of gallium and germanium, two rare earth metals that the Chinese government has introduced export restrictions for dual-use items taking effect from August 1.

Oxy-ADNOC Partnership Eyes DCC Investments. US oil producer Occidental Petroleum (NYSE:OXY) and ADNOC, the national oil company of the UAE, signed an MoU that seeks to explore joint investment in the US and elsewhere in direct carbon air-capture projects with capacity up to 1 mtpa.

Source: https://oilprice.com/