The statement from the U.S. Energy Secretary that it will be difficult to refill the SPR despite oil prices being in the desired range has added downward pressure to oil prices and limited the potential for a rebound.

Friday, March 24th, 2023

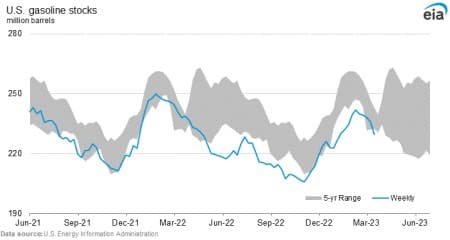

The lack of a US response to oil prices dropping into the $67-72 per barrel bandwidth after the White House had released a communique highlighting that range has puzzled the oil market. While the banking crisis in the U.S. appears to have eased, the fact that the U.S. was not refilling the SPR appeared to cap the initial rebound in oil prices. Since then, the dollar has rallied and European banking stocks have slid, sending oil prices tumbling on Friday morning. One bright spot for oil prices was the huge drop in gasoline inventories that might lead to higher US refinery runs and great crude demand.

US SPR Refill to Take Years. According to US Energy Secretary Jennifer Granholm, replenishing US strategic oil stocks will be “difficult” this year due to site maintenance as the SPR remains at 40-year lows, and it would take years to refill last year’s 180-million-barrel release.

Banking Panic Leads Investors to Drop Oil. In the calendar week ending March 14, the period of peak panic after the collapse of SVB, hedge funds, and money managers sold the equivalent of 139 million barrels in key futures and options contracts, with 90% of it coming from the Brent and WTI contracts.

French Strikes Extend into Electricity. As France has moved into the third week of nationwide protests against President Macron’s pension reforms, having already shut two refineries, the country’s power supply might be under pressure, too, as the largest LNG terminal in Dunkirk declared force majeure.

US Oil Firm Moves Ahead with Mexican Find. US offshore driller Talos Energy (NYSE:TALO) managed to iron out its differences with Mexico’s national oil company Pemex and present a development plan for the 850 MMbbls Zama oil field, the largest find in many years, ceding operator status to the Mexican NOC.

North Sea Oil Driller To be Sold. UK-based oil company Neptune Energy, backed by private equity groups Carlyle and CVC Capital and boasting a production portfolio of 135 kboepd mostly focusing on the North Sea, is reportedly seeking a full sale for more than $5 billion as talks with ENI (BIT:ENI) stalled.

Chad Nationalizes Exxon’s Oil Assets. The African nation of Chad has nationalized all exploration and production assets of US oil major ExxonMobil (NYSE:XOM), including the Doba field and the Chad-Cameroon pipeline, contesting the sale of the same assets to UK-listed Savannah Energy.

PDVSA Left with Billions of Receivables. As Venezuela’s President Nicolas Maduro named PDVSA CEO Pedro Tellechea as the country’s new oil minister, the crackdown on rampant corruption within the company has unearthed $21.2 billion in accounts receivable from bankrupt trading middlemen.

Europe Still Adds Gas Generation Capacity. With 15 GW of coal, lignite, and nuclear capacity being decommissioned this year, European countries still ramp up their gas generation capacity with 10 GW of combined and open-cycle gas plants being currently constructed, led by Greece, Italy and Poland.

Trading Majors Eye Russian Oil Again. CEOs of international energy traders Trafigura and Vitol are considering whether to resume more trade in Russian oil, arguing that they are still exporting limited amounts of products and that stronger guidance on sanctions could bring them back to crude.

Petrobras Asset Sales to be Halted. Brazil’s President Lula da Silva confirmed that his government is seeking to suspend the sales of Petrobras (NYSE:PBR) assets, citing unfavorable conditions, including the Lubnor refinery in Ceara state sold for $34 million as well as onshore fields worth $1.9 billion.

US Asks for EU Carbon Border Exemptions. As Washington and Brussels are working on a global deal on sustainable steel and aluminum, having temporarily suspended Trump-era tariffs, the US has asked for its steel and aluminum to be exempted from the EU’s carbon border levy, potentially running afoul of WTO rules.

Trafigura Expected Nickel, Stones Again. Only several weeks after trading firm Trafigura discovered systematic fraud in nickel cargoes, the Swiss-based trader found that parcels delivered into LME-registered warehouses in the United States contained only stones instead of the metal.

Chinese Lithium Prices Collapse. As demand for electric vehicles is plunging across the world, leading to an increase in lithium inventories globally, the price of the transition metal has seen a whopping 34% drop in the last four weeks alone, with benchmark Chinese prices currently trading at 38,000/mt.

Colombian Pipeline Attacks Get Worse. Marking the fifth time this year that Colombia’s pipeline system was attacked by rebels, the 220,000 b/d Cano Limon-Covenas pipe was bombed this week, just as the country’s NOC Ecopetrol (NYSE:EC) was about to resume flows after the March 17 attack.

Source: https://oilprice.com/