Nigeria’s Midstream and Downstream Gas Infrastructure Fund (MDGIF) and the African Export-Import Bank (Afreximbank) have signed a memorandum of understanding (MoU) for a four-year debt and equity plan of up to $500 million to expand and modernize Nigeria’s natural gas infrastructure.

“Afreximbank will consider providing direct financing and credit risk guarantees to support project finance transactions, working alongside local financial institutions”, Afreximbank and MDGIF said in a joint statement.

“MDGIF will consider equity contributions to complement Afreximbank’s senior debt, enabling full capital structuring for eligible projects”, the statement said.

The partners also eye “a structured program to enhance MDGIF’s institutional capabilities in project structuring, risk management and innovative financing”.

MDGIF, established under the West African country’s Petroleum Industry Act, says its primary purpose is to make equity investments “in infrastructure related to midstream and downstream gas operations aimed at increasing the domestic consumption of natural gas in Nigeria in projects which are financed in part by private investment”.

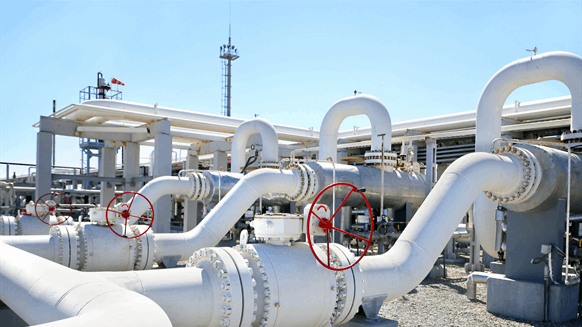

Nigerian Petroleum Resources (Gas) Minister Ekperikpe Ekpo was quoted as saying in the statement, “Through this partnership, we are unlocking the potential to mobilize up to $500 million over the next four years for Nigeria’s gas infrastructure. More importantly, we are creating a pipeline of bankable projects, supported by feasibility studies, project preparation and risk-sharing mechanisms, that will accelerate the pace of investment in pipelines, processing”.

Kanayo Awani, executive vice president for intra-African trade and export development at Afreximbank, said, “By combining Afreximbank’s deep expertise in trade and project finance with MDGIF’s national investment reach, we are poised to unlock new opportunities for inclusive growth and sustainable development across Nigeria and, potentially, across the West Africa sub-region”.

MDGIF executive director Oluwole Adama commented, “[T]his partnership with Afreximbank enables MDGIF to mobilize capital, expand critical midstream and downstream infrastructure, reduce flaring and deliver sustainable energy solutions that power industries, create jobs and improve livelihoods across Nigeria”.

The agreement was signed at the Intra-African Trade Fair, organized by Afreximbank, the African Union Commission and the African Continental Free Trade Area. The recently concluded gathering generated over $48 billion in trade deals, according to the statement.

Production Growth

Earlier Nigeria’s upstream regulator reported a growth in natural gas production to 7.59 billion standard cubic feet a day (Bscfd) in July.

That was up 8.58 percent from last year’s daily average and 9.84 percent compared to 2023, the Nigerian Upstream Petroleum Regulatory Commission said August 30.

Gas supplied to power plants hit a three-month high at 862.86 million scfd, up 3.48 percent from June, the report said.

“In terms of Domestic Gas Delivery Obligation (DGDO) performance, the sector delivered 72.5 percent in July 2025, up from 71.8 percent in June”, the report said. “Data from the commission further shows that DGDO performance stood at 72.2 percent in January, rose to 73.5 percent in February, dipped slightly to 70.8 percent in March, before climbing again to 73.7 percent and 73.0 percent in April and May, respectively”.

In the year to July, 35.88 percent of output was exported, 27.82 percent supplied to the domestic market and 29.13 percent used by producers for field and plant operations, the report added.

Source: By Jov Onsat from Rigzone.com